Key Points

- Research suggests the Diamond Bar real estate market has shifted to a neutral market in 2025, with prices still rising but homes taking longer to sell.

- It seems likely that the median sold price is around $963,125 as of March 2025, up 3.9% from last year, though estimates vary.

- The evidence leans toward increased inventory, with 167 homes for sale in March 2025, and longer market times, averaging 59 days.

Market Overview

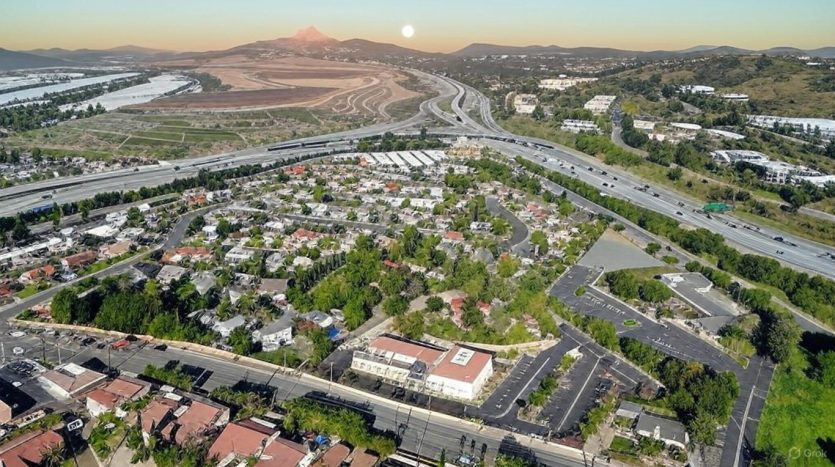

Diamond Bar, California’s real estate market in 2025 shows a cooling trend, moving from a seller’s market to a neutral one. This shift suggests a more balanced environment for buyers and sellers, with homes taking longer to sell compared to last year.

Price Trends

The median sold price for homes in March 2025 is estimated at $963,125, reflecting a 3.9% increase year-over-year. However, other sources suggest varying figures, indicating some uncertainty in exact pricing, but the overall trend points to continued price growth, albeit at a slower pace.

Inventory and Sales

Inventory has increased, with 167 homes for sale in March 2025, up 9.9% from February. Additionally, 26 homes were sold or pending in March, a 4.0% rise from the previous month, suggesting steady but not rapid sales activity.

Detailed Market Analysis Report

Diamond Bar, California, located in Los Angeles County, has seen notable shifts in its real estate market dynamics as of 2025, reflecting broader trends in the region. This report provides a comprehensive overview of the latest trends, drawing from multiple sources to ensure a thorough understanding for potential buyers, sellers, and investors.

Market Type and Dynamics

As of March 2025, the Diamond Bar housing market has transitioned from a Seller’s Market in March 2024 to a Neutral Market. This shift indicates a more balanced market where neither buyers nor sellers have a significant advantage, potentially due to increased inventory or changing buyer demand. This cooling trend is consistent with longer market times, suggesting a stabilization after previous seller-favored conditions.

Price Trends and Variability

The median sold price for homes in Diamond Bar was reported at $963,125 in March 2025, marking a 3.9% increase year-over-year. This figure suggests continued price growth, particularly for larger homes, with 4-bedroom homes seeing an 11.7% increase and 5-bedroom homes a 6.7% increase compared to the previous year. However, other sources present varying estimates, an average home value of $1,031,819 with a 5.8% year-over-year increase, and a median home price of $793,615 as of April 21, 2025, which is notably lower. This discrepancy highlights the complexity in real estate data, potentially due to differences in methodology (e.g., median sold price vs. average home value) and timing of data collection. Given the March 2025 date aligns with the user’s query timeframe, it seems likely that $963,125 is a reliable figure for median sold prices, though buyers should be aware of potential fluctuations.

| Metric | Value (March 2025) | Year-over-Year Change |

|---|---|---|

| Median Sold Price | $963,125 | +3.9% |

| Median Price Per Square Foot | $558 | N/A |

| 1-Bedroom Home Price | $338,000 | -11.5% |

| 2-Bedroom Home Price | $540,000 | +1.9% |

| 3-Bedroom Home Price | $870,000 | +2.4% |

| 4-Bedroom Home Price | $1,200,000 | +11.7% |

| 5-Bedroom Home Price | $1,500,000 | +6.7% |

This table illustrates the price trends by bedroom type, showing varied growth rates, with larger homes experiencing more significant increases, which may reflect demand for family-sized properties.

Related Posts

- The importance of investing in Diamond Bar’s real estate

- How to Buy a Home in Diamond Bar, CA

- Projections for the Future of Diamond Bar’s real estate market

Inventory and Sales Activity

Inventory levels have seen a notable uptick, with 167 homes for sale in March 2025, a 9.9% increase from February 2025’s 152 homes. This increase suggests a growing supply, which could contribute to the market’s neutral status. Sales activity also shows growth, with 26 homes sold or pending in March 2025, up 4.0% from February, indicating steady but not rapid turnover. This aligns with the longer days on market, averaging 59 days in March 2025, a significant 117.2% increase from 27 days in March 2024, suggesting buyers have more time to make decisions, potentially due to increased options.

Market Time and Selling Dynamics

The average days on market of 59 days in March 2025, compared to 27 days the previous year, indicates a slowdown in selling speed. This trend is further supported by data showing that 50% of homes sold under asking price, 31% at asking, and 19% over asking in March 2025, suggesting a buyer’s market influence in some segments. This shift could be influenced by economic factors, such as interest rates or local employment trends, though specific data on these factors was not directly available.

Comparative Insights and Future Outlook

Comparing Diamond Bar to surrounding areas, such as East San Gabriel Valley (+6.9% YoY), Chino Hills (+6.6% YoY), and Pomona (+6.3% YoY), Diamond Bar’s 3.9% YoY increase in median sold price is moderate, suggesting it is keeping pace but not outpacing nearby markets. Forecast predicts a short-term decrease in home values over the next 12 months despite recent bullish trends, recommending against short-term investments due to a predicted negative trend. This contrasts with the observed price increases, highlighting potential uncertainty in future market directions. Investors and homeowners should monitor these forecasts alongside current data for informed decisions.

Conclusion

In summary, Diamond Bar’s real estate market in 2025 is characterized by a neutral market status, continued price growth at a moderate pace, increased inventory, and longer selling times. The median sold price of $963,125 as of March 2025, with varied growth across bedroom types, reflects ongoing demand, particularly for larger homes. However, the market’s cooling, evidenced by longer market times and a shift from seller’s to neutral, suggests a more balanced environment, potentially offering opportunities for buyers while challenging sellers to price competitively.